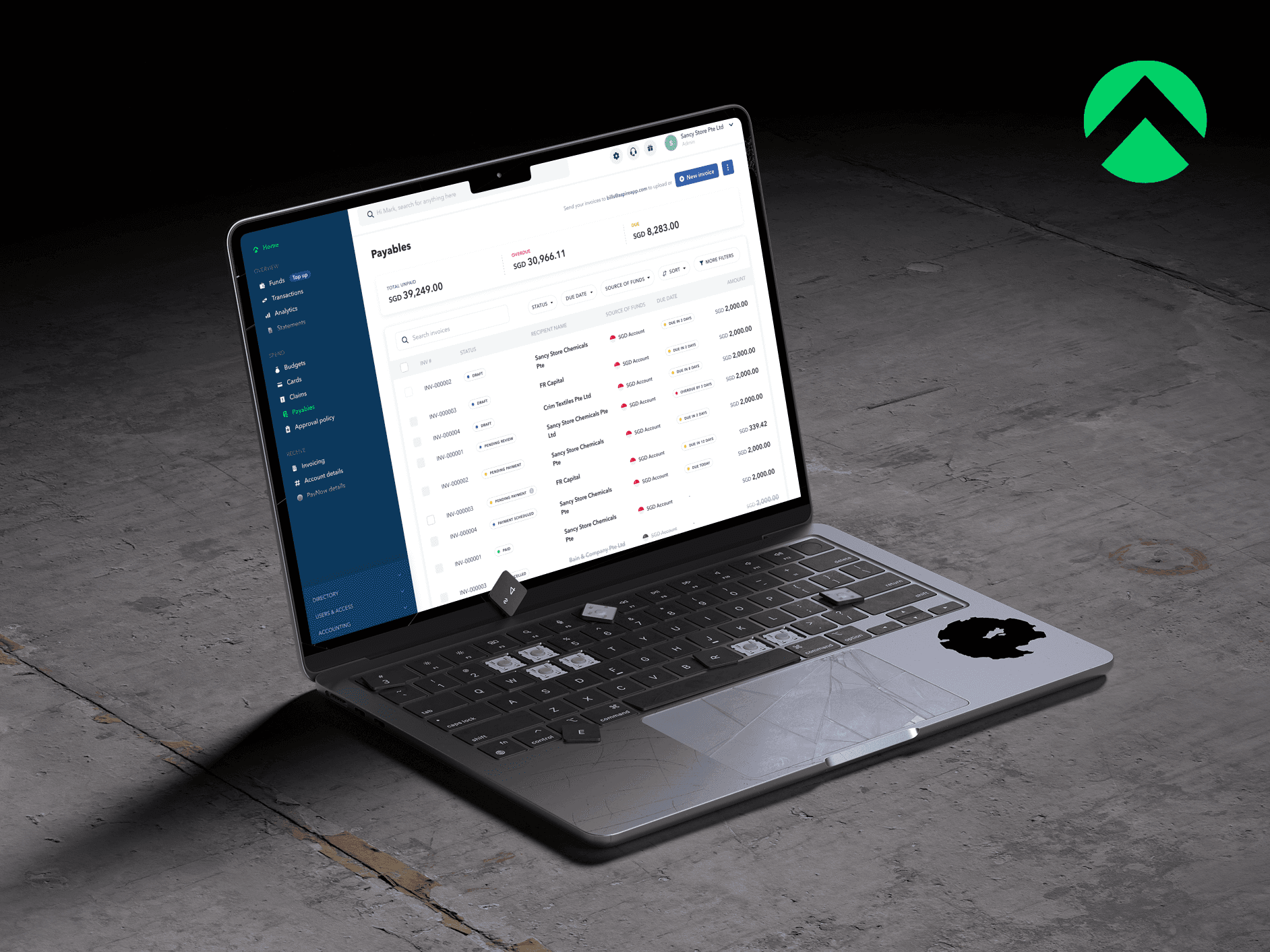

Reimagining Invoice Management at Aspire

Sr. Product Designer • Aspire, SG (Series C)

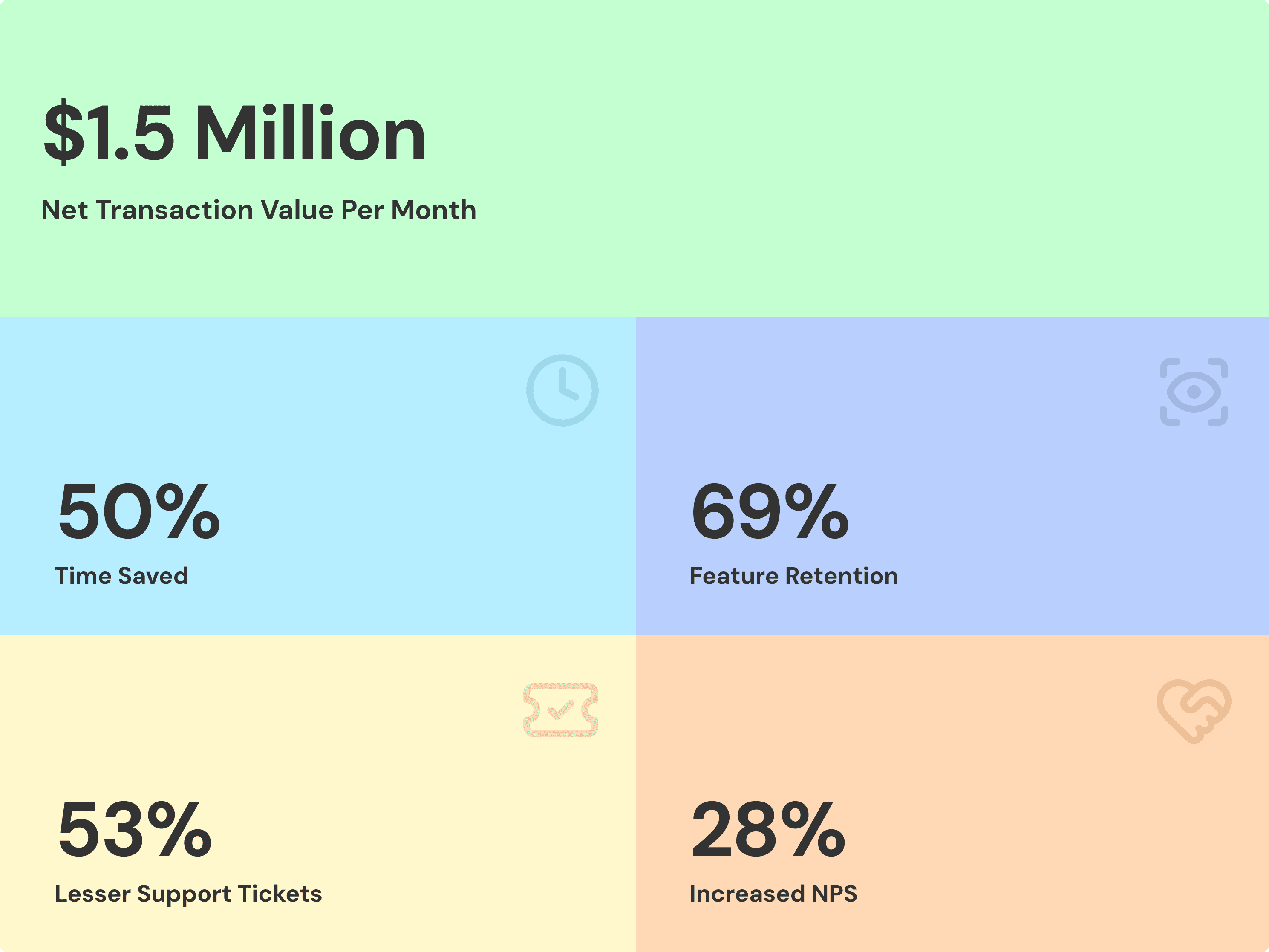

As the sole designer, I partnered with 2 Product Managers to scale Aspire’s invoice management into an automation-first workflow. Reaching over $1.5M monthly NTV through a focus on trust, clarity and adoption.

Overview

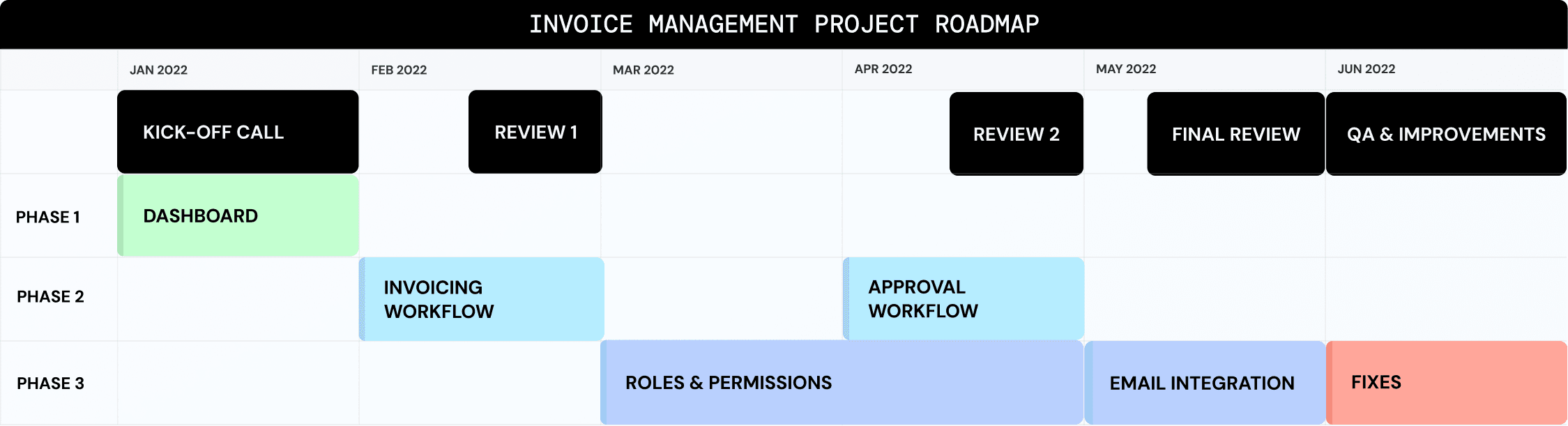

Approach: Phased Value Delivery

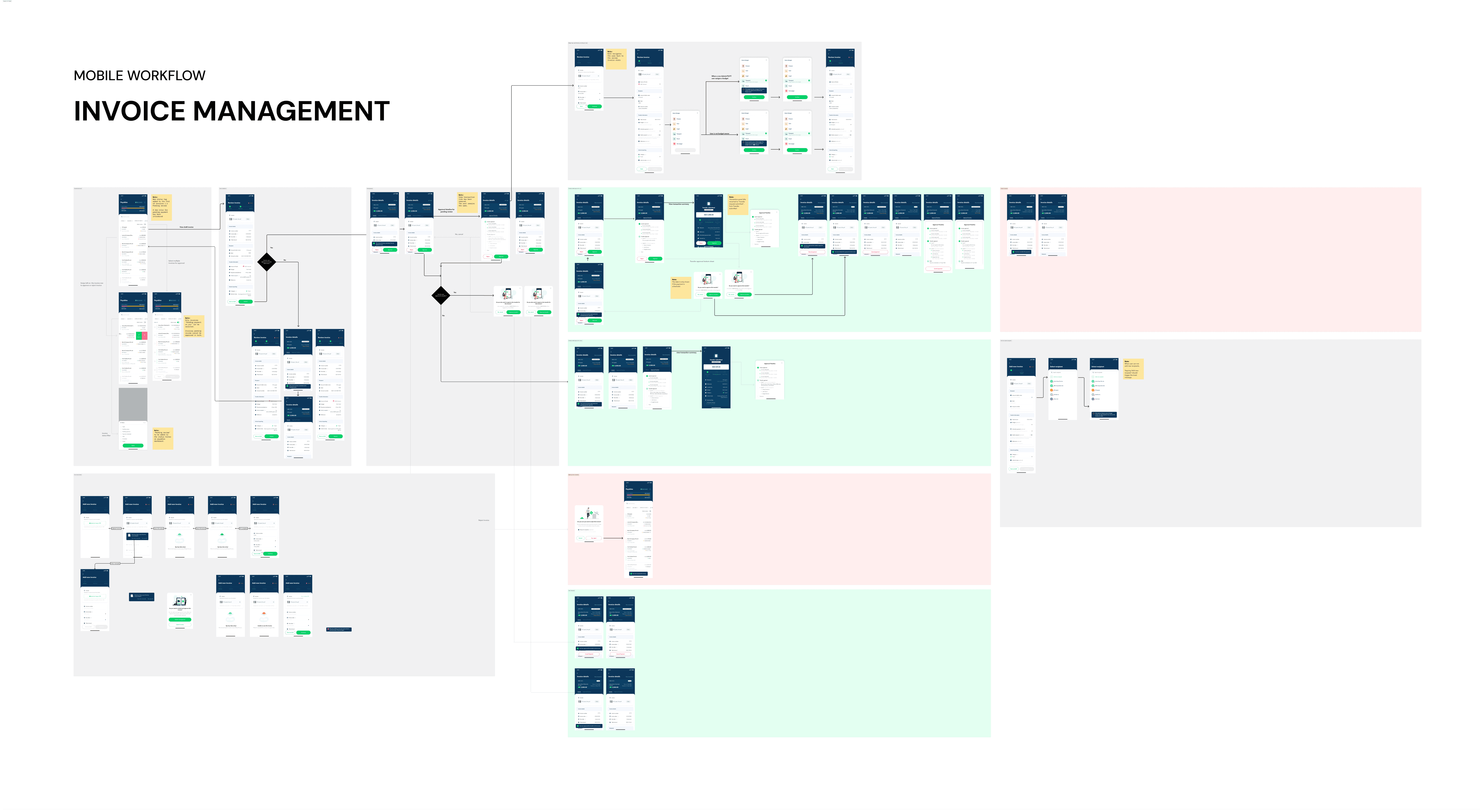

I owned end-to-end workflow design across three phased releases and drove continuous alignment with PMs and engineering, operating in a triad model focused on phased value delivery and fast convergence over pixel-level divergence.

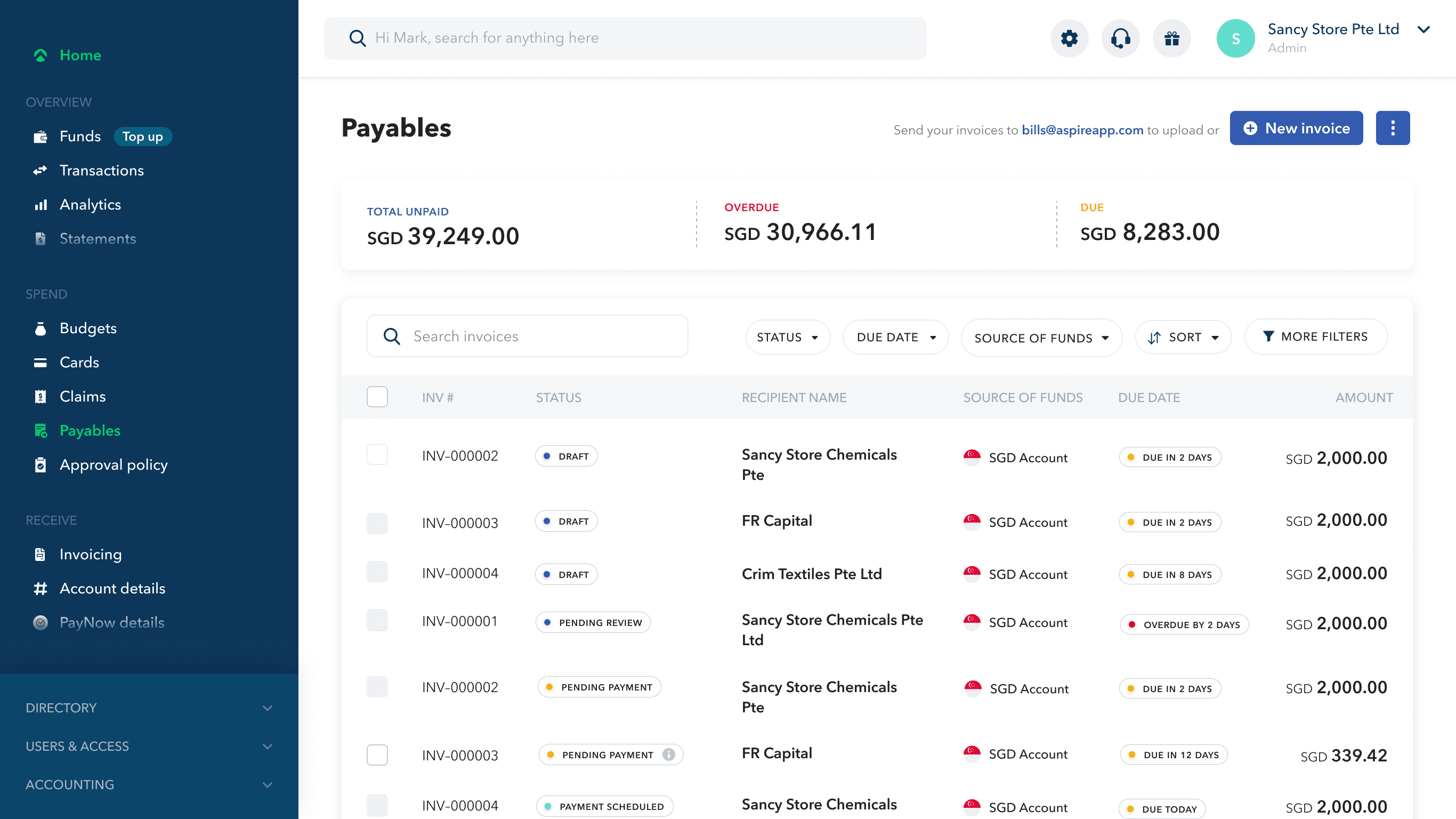

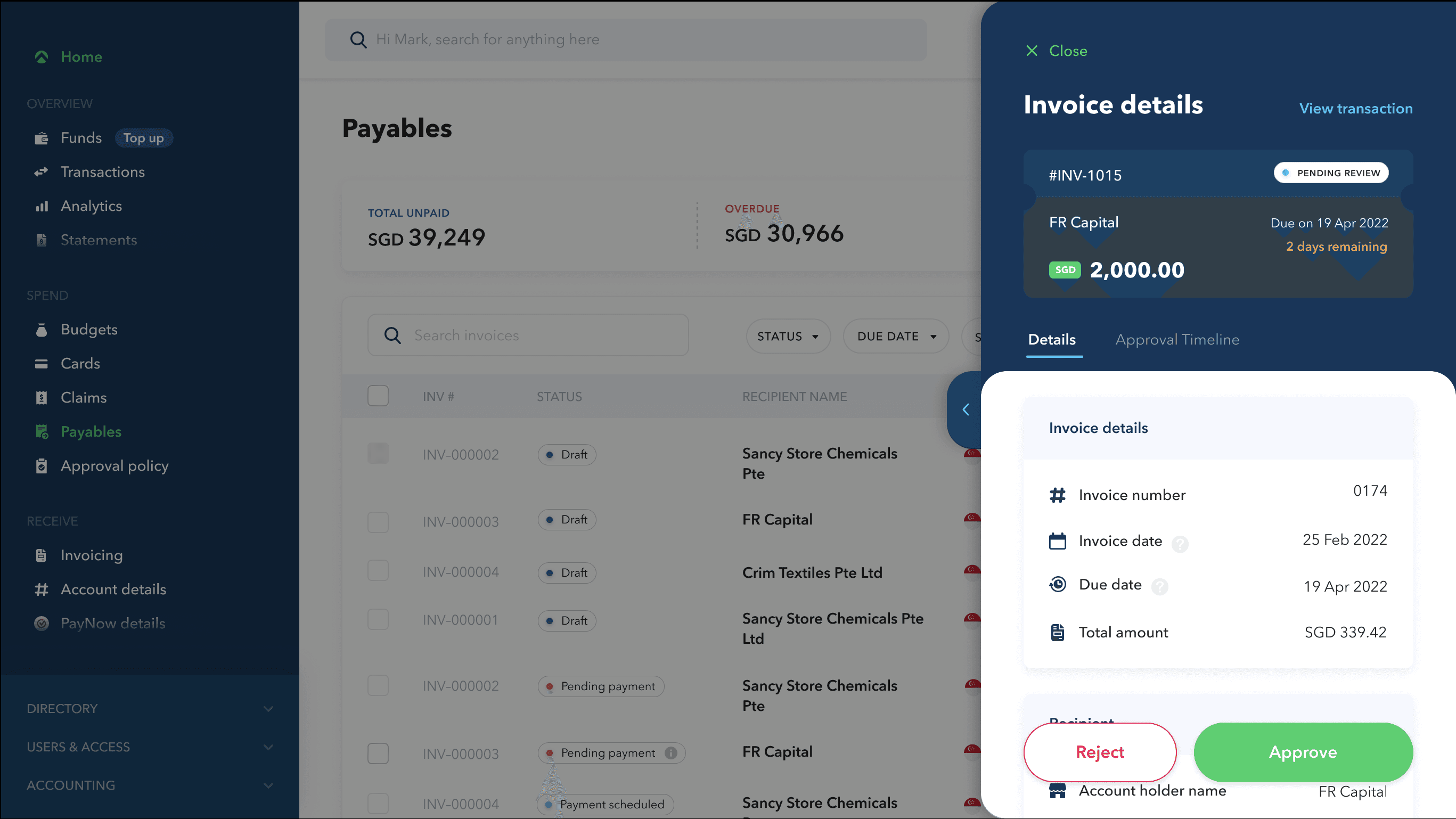

Phase 1: Dashboard & Workflows

This project reinforced my ability to own ambiguous problem spaces end-to-end, design scalable systems, and translate business goals into user-centered outcomes as a solo designer in a high-stakes fintech environment.

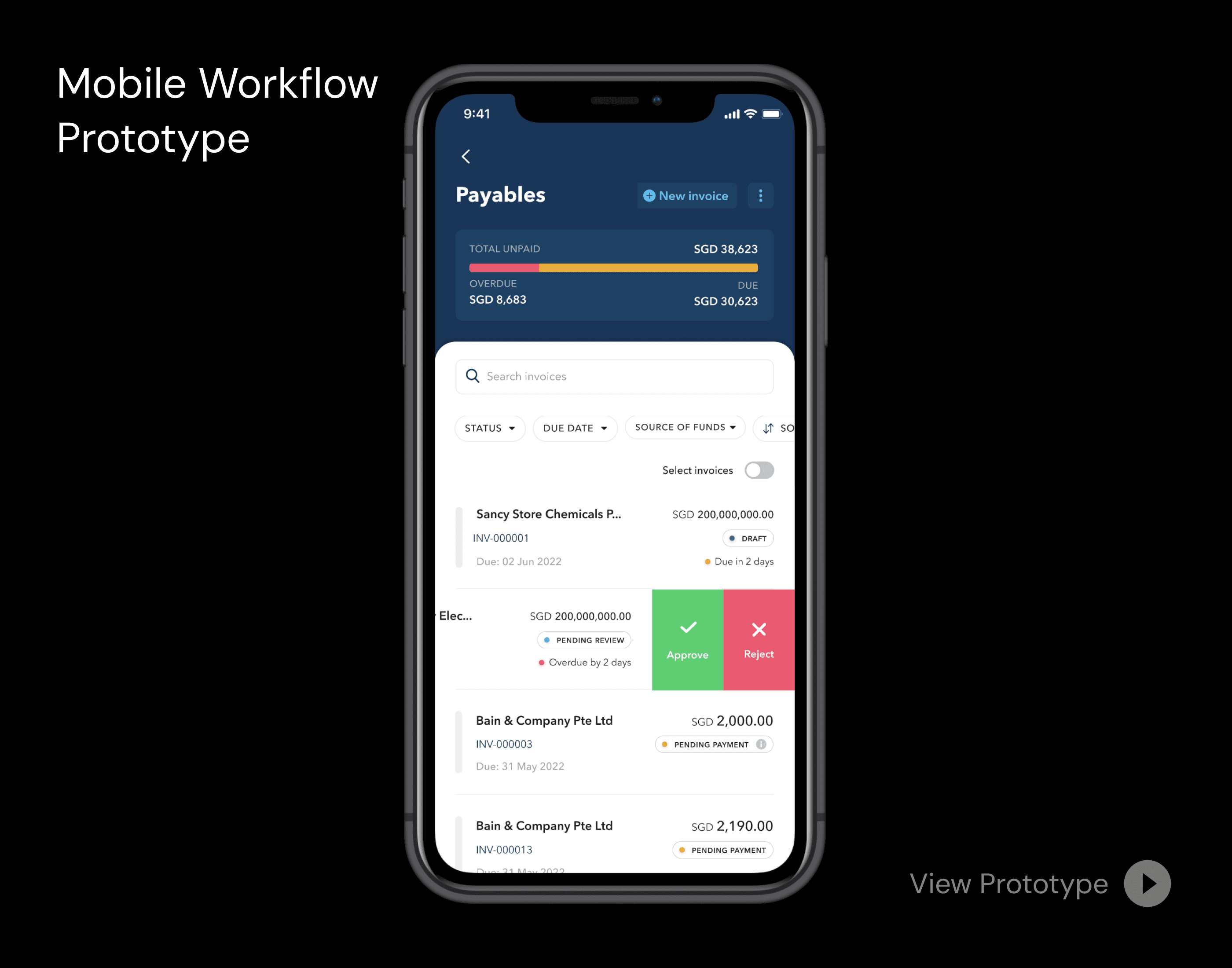

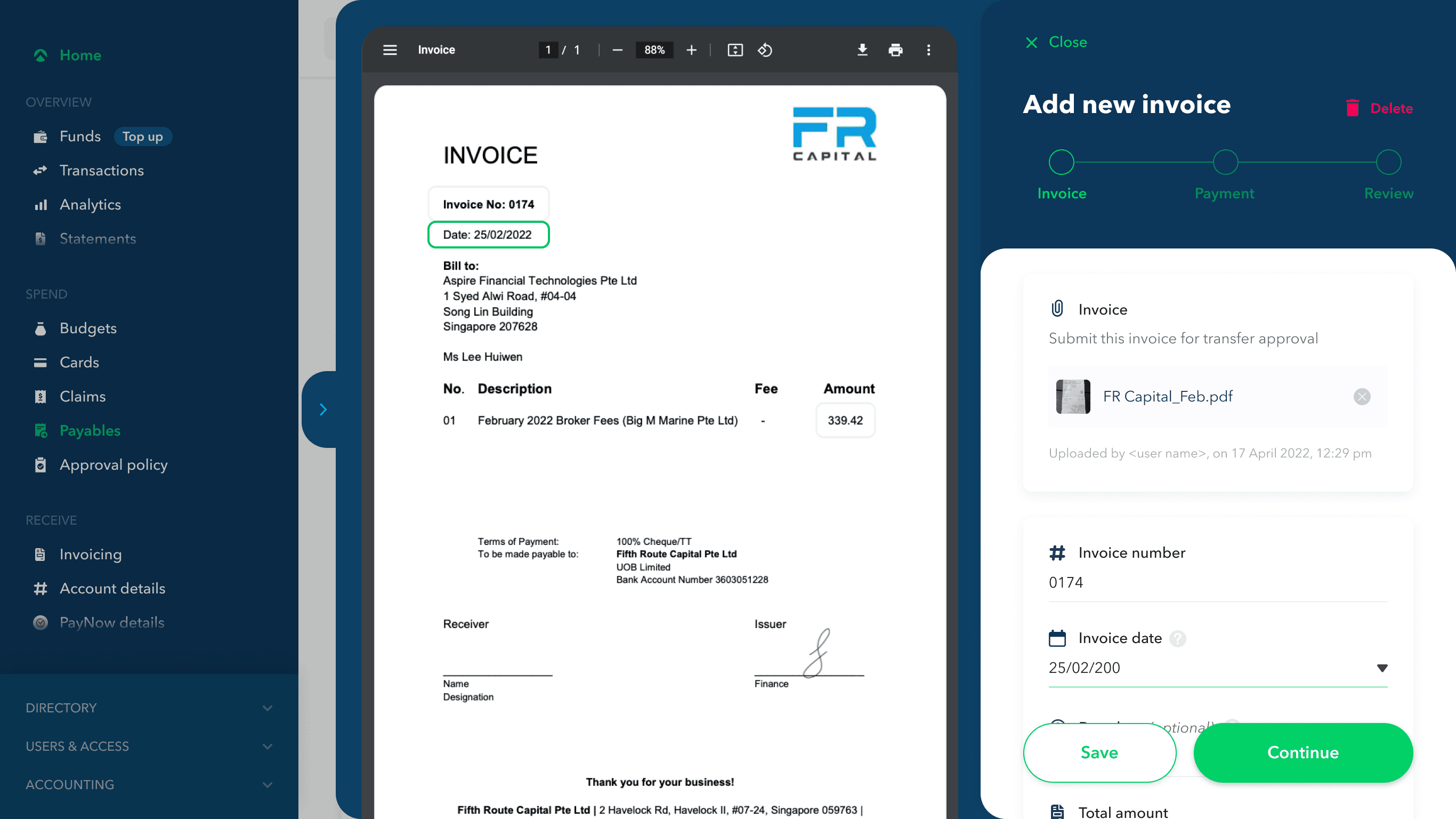

Phase 2: Invoicing & Approval Workflow

This project reinforced my ability to own ambiguous problem spaces end-to-end, design scalable systems, and translate business goals into user-centered outcomes as a solo designer in a high-stakes fintech environment.

Phase 3: Roles & Integrations

This project reinforced my ability to own ambiguous problem spaces end-to-end, design scalable systems, and translate business goals into user-centered outcomes as a solo designer in a high-stakes fintech environment.

Outcomes & Impact

Scaled the invoice feature to $1.5M+ in monthly NTV with 69% retention, driven by major reductions in manual effort and errors.

Reflections

This project reinforced my ability to own ambiguous problem spaces end-to-end, design scalable workflows, and translate business goals into user-centered outcomes as a solo designer in a high-stakes fintech environment.

The key lesson wasn’t about OCR or approvals, but about sequencing trust before automation. By making the system easy to use, we created the conditions for automation to succeed.